WeChat Pay is a digital payment solution owned by Tencent Holdings, the same company that operates China’s largest social media platform. In a highly competitive, mobile-first industry such as China, you don’t have over 900 million active users without creating something special. In this article, we’ll explain everything you need to know about the game-changing payments app that they call WeChat Pay.

Introduction to WeChat

Before you can use WeChat Pay, you must register to use WeChat, which is practically a given in China. Rich Turrin, author of the international best-seller “Cashless—China’s Digital Currency Revolution,” said that “WeChat is the dominant social network, so if you want to be able to send money to people, you have to be on WeChat.”

Launched in 2011 as a messaging app, WeChat is the brainchild of Allen Zhang, a legend in China’s tech sector who once said, “Before perceiving WeChat as a commercial product, I’d rather picture it first as an impressive work of art.” And impressive it is. Known as the “Super app of the East”, WeChat dominates daily life in China. More than 1.35 billion people use it every month. It is world-beating. In the words of the New York Times, “Forget TikTok. China’s Powerhouse App is WeChat.”

WeChat has three core services: instant messaging, social media service, and payments, and then everything else. Described by The Guardian as “a Swiss army knife app,” WeChat can do an astounding number of things. You can use WeChat to play some incredible online games, apply for a visa, file for divorce, book a hospital and doctor, network, Job search, make restaurant reservations, do online shopping and banking, and organise your travel.

What is WeChat Pay?

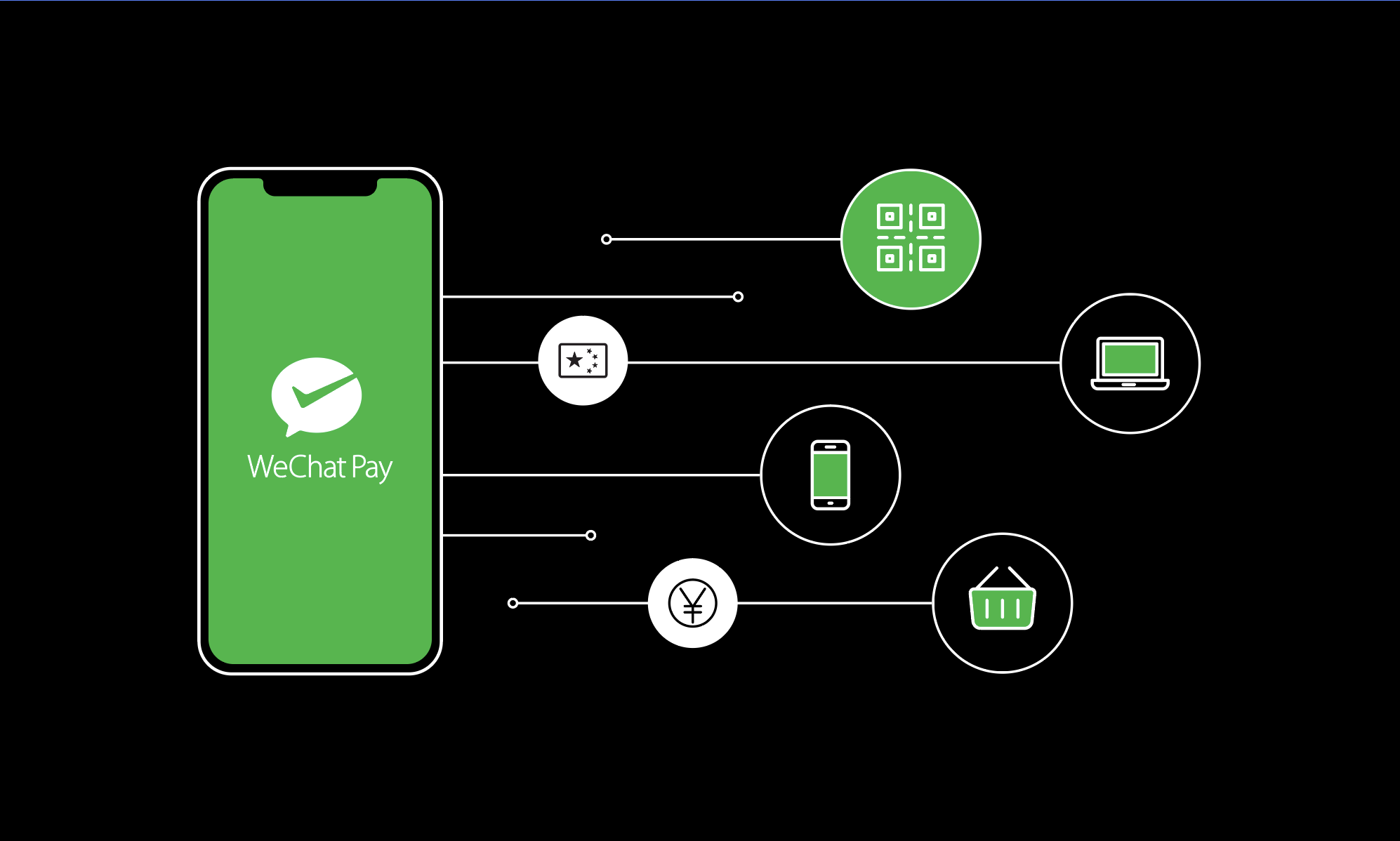

Also known as Weixin Pay, WeChat Pay is a mobile payment system and digital wallet service that enables WeChat users to make payments directly through the app. WeChat Pay supports several payment flows, including QR code, in-app, Mini Program, and Official Account payments.

Collectively, these payment flows offer merchants a wide variety of touchpoints and sales opportunities to choose from whilst helping them engage new consumers and increase sales revenue.

Is WeChat Pay safe?

It’s in every payment provider’s interest to ensure that the payment details of its customers remain safe and secure. This is no different for WeChat Pay, which is working tirelessly to improve its security protocols continually and address the complex challenges of safeguarding personal finance data. Such security measures include:

- Multi-layered encryption – WeChat Pay has adopted the Advanced Encryption Standard (AES), which is approved and used by the US Government and global financial institutions. AES is a symmetric type of encryption, because it uses the same key to both encrypt and decrypt data. It also uses the SPN (substitution permutation network) algorithm, which means that it applies multiple rounds to encrypt data, making it hard to penetrate because there are too many rounds for hackers to break through. WeChat Pay applies this protocol to both in-transit and at-rest data, with specific encryption methods created for each phase of data handling.

- Real-time monitoring and risk management - WeChat Pay utilises advanced risk management systems that monitor transactions for suspicious activity. They have created machine learning algorithms that can interrogate vast datasets. This enables WeChat Pay to detect and respond to potential fraud in real-time, reducing the risk of unauthorised transactions.

- Compliance with local and global standards - All payment providers must follow the Payment Card Industry Data Security Standard (PCI DSS) and WeChat Pay is no exception. It also complies with financial regulatory requirements in China and across all other operational territories.

- Payment authentication protocols - WeChat Pay employs multi-factor authentication protocols, including passwords and SMS verification. It also utilises mobile device biometric checks, such as fingerprint and facial recognition.

- Tokenisation technology - Tokenisation is a security technique that replaces a customer’s bank account or card numbers with a unique token for each transaction. This makes it very hard for hackers to identify and obtain the user’s payment details.

- Data privacy controls - WeChat Pay takes customer privacy seriously. Its system is deliberately designed to share only information necessary to complete a transaction.

- Regular security assessments – The PCI DSS requires its members to undergo regular security measures to test and improve its defences against new and evolving threats. These include penetration testing and audits by internal and external security experts who can exploit all opportunities to stress test WeChat Pay’s security defences.

- Customer education - WeChat Pay also educates its users about the importance of online and mobile security matters. They push out notifications warning customers of common scams and publish blogs that educate customers on how to protect their personal information by, for example, recognising phishing attempts and setting strong passwords.

- Privacy - WeChat Pay users are asked to review a summary of their privacy policy and the option to review it in detail. This explains:

What information users need to provide (such as a nickname, mobile number and password)

How they will use customer information

Who else can access user data. WeChat Pay don’t share customer data with any third parties except where they need to provide the service, for example, use an SMS service provider for account validation

Where they process user data, which is currently via servers in Ontario, Canada and Hong Kong

How long they keep user data for

How users can exercise your rights over your data

How they will notify users of any changes to their privacy policy

How to contact them with any concerns or complaints

How to use WeChat Pay

To access WeChat Pay, you must first download the WeChat app. Although WeChat Pay was built and designed for Chinese citizens, Tencent Holdings continues to improve the experience for non-Chinese citizens and non-permanent residents.

Although you will get more out of WeChat Pay if you have a Chinese bank account, you can still use WeChat Pay if you have an international credit or debit card with international financial services providers such as Visa, Discover Global Network, JCB, and Mastercard. Once the cards are successfully linked, foreign users can use WeChat Pay to pay merchants across various sectors, including dining, shopping, transportation, and hotel accommodation.

The first step to using WeChat Pay is to download the WeChat app. You can do this by following these simple steps:

1. Download the International WeChat app in the app store.

2. Open the WeChat app and register with your phone number or sign in if you have already registered.

3. Read the privacy summary and click ‘next’ if you are happy to accept it.

4. Complete a security verification, which is currently a simple ‘slide the puzzle’ exercise.

5. Invite another WeChat user to scan the QR code via their WeChat app. This is required as an authentication step. You will also need to provide proof of authentication by using one of the following six types of documents:

- Passport.

- Foreign Permanent Resident ID Card.

- Mainland Travel Permit for Hong Kong and Macao Residents.

- Mainland Travel Permit for Taiwan Residents.

- Residence Permit for Hong Kong and Macao Residents.

- Residence Permit for Taiwan Residents.

Foreign users can bind their cards to WeChat Pay by following these simple steps:

- Check that you have the latest version of WeChat

- Open WeChat and click on the “Me” section

- Click on “Wallet” to access payment options

- Click on “Bank Card” and then “Add a New Bank Card”

- Enter the card number before selecting the card type and issuer before completing the required card and personal information before clicking “Submit.” During this process, you will be asked to submit a six-digit PIN. Remember this PIN, as you must finish the payment with the merchants. You will receive a confirmation message when the binding is successful

Foreigners are unlikely to have a Chinese bank account, so you will have to link your credit or debit card to WeChat Pay. There are limitations to this:

- You can not top up or receive Chinese Yuan

- There may be limits on how much you can WeChat Pay for, however the limits may be higher if your identity has been verified with a proof of passport

- Some merchants will not be able to accept WeChat Pay payments from foreign WeChat Pay users. This is because all merchants need to apply to WeChat Pay for the right to accept credit and debit cards through networks such as Visa, Mastercard and American Express. If the merchant isn’t displaying stickers advertising that they accept these networks, then it is unlikely that they will be able to accept a foreign WeChat Pay

- WeChat Pay customer service is manned in mainland China and they do not currently offer a translation service, or the opportunity to speak in an alternative language

How does WeChat Pay work?

WeChat Pay can be used on desktops and mobiles to take payments of between 0.01 Yuan (or equivalent in other currencies) and 50,000 Yuan, although foreign users may experience lower limits. Businesses are charged a transaction fee for each payment. This fee is typically a percentage of the transaction amount and varies depending on various factors, including the merchant’s sector and location.

Merchants can currently use WeChat Pay to support 26 settlement currencies, including US dollars, Euros, and British pounds. WeChat Pay merchants are expected to display the WeChat Pay logo for their customers to see.

Although WeChat Pay supports several different payment flows, it doesn’t currently process customer recurring payments. Here is a summary of how each payment flow works.

- QR code - WeChat Pay’s use of QR codes as a payment mechanism has transformed financial behaviour in China. QR codes can take in-person and online payments. The merchant generates payment collection codes for each individual payment so that the customer can open their WeChat app to scan the code at the checkout and approve the transaction amount by using their password to complete the payment. The merchant and the user will receive a confirmation once the payment is successful.

- In-app payment—This is a good payment flow for merchants with many Chinese customers. Its workings are simple. When a user chooses to settle a transaction via WeChat Pay, they are automatically redirected to WeChat for verification. Once the payment has been made, they will be redirected to the app to receive confirmation that the transaction has been successful.

- Mini Program payment – This is a merchant-created sub-application that sits within the WeChat ecosystem. It allows users to buy from a merchant’s online shop through an offline storefront hosted on WeChat. Once users have opened the Mini Program, they add items to their cart before paying for them via WeChat.

They’ll then be redirected back to the merchant’s Mini Program. Merchants can use Mini Program payments to expand their reach to consumers who may not otherwise have discovered their store. Mini Program payments are also excellent at building trust because they don’t require users to leave the WeChat app to make purchases.

- Official Account payment – Similar to a public social media profile on WeChat, this is where merchants can attract new customers by promoting their brand and services. It’s a handy way to engage directly with consumers and encourage them to purchase by messaging and posting.

Customers will add items to their basket using the merchant’s official account before being redirected to WeChat to complete the payment. The payment itself takes place within the WeChat app but is processed by the merchant’s payment provider, thus eliminating the need to take the customer to a third-party payments page. Once the payment has been authorised, the customer will be redirected back to the merchant’s Official Account.

WeChat Pay is more than just a payment solution; it’s a seamless, secure, and integral part of China’s digital landscape. From effortless transactions to cutting-edge security features, it’s designed to meet the needs of its vast user base. Ready to explore the future of digital payments and elevate your payment experience?