In the hypercompetitive ecommerce world, offering plentiful choices that meet the increasing customer desire for autonomy is now the go-to strategy for success. When it comes to payment methods, it might seem that providing as many options as possible is the right approach. Think again.

Decision fatigue and the paradox of choice are the latest buzzwords in the consumer field. From endless TV shows to choose from every night to numerous podcasts to listen to on the commute, our options today are truly endless. But it’s become a little too much and is now preventing any decisions from being made at all. This seeps into ecommerce and the crucial point of choosing how to pay for products and services online.

Let’s examine the ecommerce market, how providing choice is both optimal but creates confusion, and how to find the best balance when it comes to payment method options.

What is the paradox of choice?

Coined by author Barry Schwartz, the paradox of choice is the idea that while we may believe having multiple options makes it easier to choose and therefore increases customer satisfaction, the opposite is true.

In fact, the abundance of choice requires more effort to make a decision and in turn, can either make a customer step away altogether or feel unsatisfied from their final decision.

Within the ecommerce context, there hasn’t ever been so much choice and all at a person’s fingertips. From the type of product they’re after to the best deal, the ecommerce industry has become ultra competitive and is becoming harder to stand out and encourage loyalty. Together, this makes for greater risk of a lost sale or an unhappy customer.

If you add payment method choices into the mix too, striking the balance of ‘just enough’ choice has never been more important.

Ecommerce today

Ecommerce sales continue to increase globally. It was estimated that 2023 saw sales reach $5.8 trillion and by 2027, figures are expected to hit over $8 trillion. It’s a booming industry that sees more consumers shopping internationally as borders are no longer a barrier to successful delivery or local currency payments.

With the rise of algorithms and technology in people’s everyday lives too, consumers are expecting greater personalised experiences. While this includes tailored suggestions and recommendations, it also extends into the experience seamlessly fitting into a customer’s day. More want the end-to-end customer purchasing journey to be just as easily completed on the go on their mobile phone as it is sat at their desk on a laptop. With this flexibility, customers feel and believe they have more choice.

At the heart of all this is choice. Consumers want to choose how they experience a brand and on their own terms. When this isn’t offered, carts become abandoned. On average, cart abandonment currently sits at 70% for online shopping - a huge chunk of lost revenue.

Offering different payment methods and the benefits

The final online component of the ecommerce journey is the payment stage, which is arguably one of the most important of them all.

At this point, it’s important to provide the right payment options to customers including some newer entrants, too. Various payment methods include:

- Credit and debit cards

- Digital wallets (Apple Pay, Google Pay, PayPal)

- Direct bank transfers (Pay by Bank)

- Cryptocurrency

- Buy Now, Pay Later (Klarna, Clear Pay)

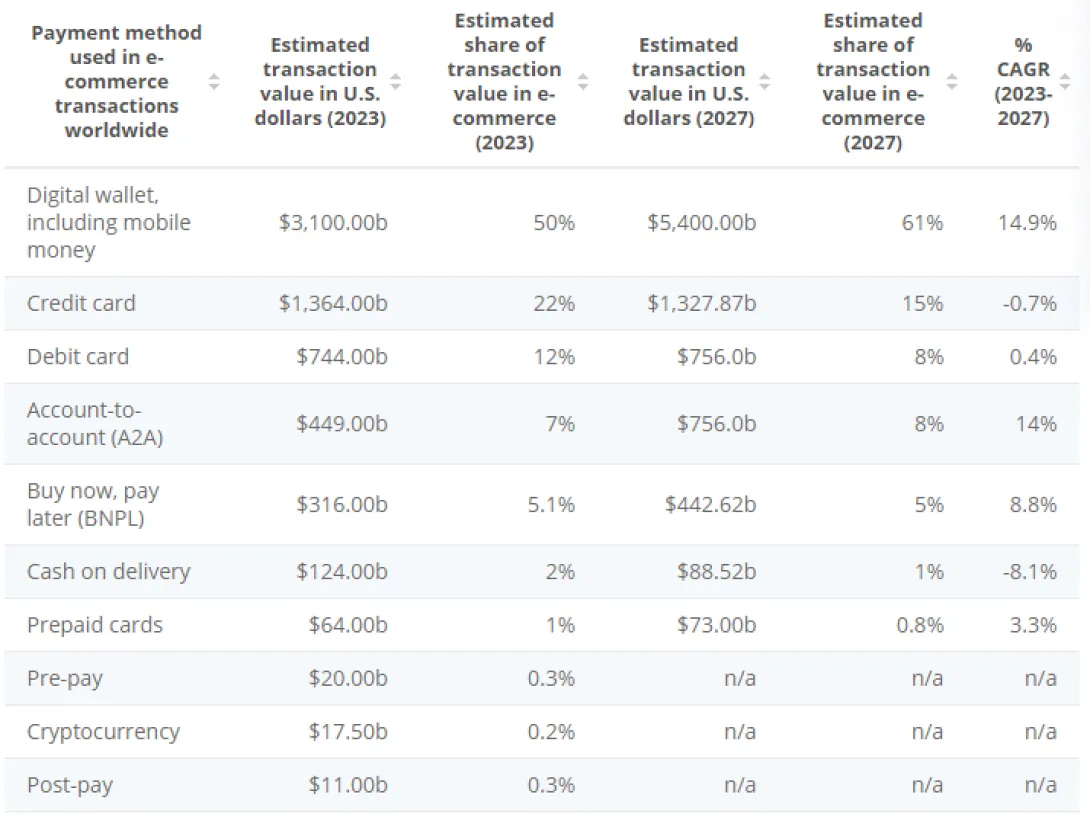

The most popular payment methods

Why offer different payment methods?

A familiar customer experience

As mentioned, consumers increasingly want to curate their experience to fit with their personal needs and situation. When it comes to checking out online then, customers are more likely to go ahead with the purchase by paying in the way most familiar to them.

By offering a variety of payment methods, they can choose what feels most comfortable, secure and reliable resulting in a simple, predictable payment experience.

Lower cart abandonment rates

Often, cart abandonment happens because what the customer wants in the final stages (preferred delivery or payment method) isn’t offered. This causes doubt and reconsideration.

To take away this indecision, it’s important to give solid options that make the decision-making process as quick and easy as possible, including payment methods. Once a customer sees their preferred way of paying, it’s quite literally just a click away for them to finalise their decision.

Greater customer loyalty

A seamless customer experience equates to a satisfied customer, who will likely return and recommend your business to others. And in the highly competitive ecommerce space, customer loyalty is like gold dust.

Making small but significant adaptations to the customer journey at the checkout stage could result in greater revenue and retention in the long run for your business.

Become a global business

Different countries and regions have different preferences in their payment methods. For example, in China, Alipay and WeChat Pay are the most common way to make payments. Meanwhile, the UK and US have a greater preference towards debit and credit cards respectively.

With good knowledge of your customer base and where they’re located, you can tailor the checkout experience as if you were a local business.

The problem with too many payment methods

Choice overwhelm

While variety and enabling autonomy in the customer journey is key to a good customer experience, we come back to the paradox of choice.

If you imagine viewing a plethora of payment methods at the final buying stage, it’s likely you’ll feel quite overwhelmed and confused. At this point, you may become disengaged and want to walk away after all the decisions you’ve already made to fill up your cart.

Additionally, with so many options, it might be harder to find your preferred payment method - even if it was there.

High costs

Put simply, more payment methods means more fees to manage. Each has their own setup, maintenance and transactions fees, with some having a sliding scale on the latter. This makes it not only more expensive as a business owner, but also harder to predict the bottom line because of the many variables.

Having varying payment processors and gateways will also require significant time from tech resources to ensure integrations with the various systems remain steady.

Reduced customer trust

With too many payment choices available, your site could start to look fraudulent and untrustworthy because of the overcrowded design.

Consumers are becoming savvier and more vigilant to fraud and scams, so keeping a clean design helps to build trust in your brand.

How Planet helps you stay relevant to your audience’s payment choices

Planet’s Online Payment Gateway offers a multitude of payment methods and small but significant options to create a truly effortless and tailored checkout experience for your customers.

Multiple payment methods

Whether it’s through the API, plugin or mobile SDK, Planet provides your ecommerce store with multiple payment options that you can tailor according to your target audience’s expectations.

For example, if you find that more customers are China-based, you can add Alipay as an option. Or, if your target audience is mainly Gen Z, our API offering includes various Buy Now Pay Later options—most used by those under 30.

It’s also possible to automatically adapt the checkout according to region. So those in the UK will see their preferred payment methods, while Germany, for example, will see those preferred in that market.

Pay in local currency

Planet’s Online Payments Gateway also offers pricing and payment in a customer’s domestic currency. This means that no matter where your customers are, your offer remains relevant and relatable, helping them make decisions faster.

Additionally, Planet’s Dynamic Currency Conversion can provide an additional revenue stream as Planet provides a rebate to merchants who use the service.

Simple design

When it comes to strong customer experience, a clean design is essential. Planet provides a simple and intuitive UI so customers are able to choose how they pay easily.

Research shows that the average number of payment methods offered by smaller businesses is 4.2, while for larger companies, this increases slightly to between 4.5 and 5.

One-click checkout

Customer card details are kept secure with the use of tokens meaning that when they return, they can pay without needing to enter their details again.

Final words

Consumers know that they have a world full of choice at their fingertips today when it comes to shopping online. While having options is now expected, it’s important to avoid overwhelm and to keep processes simple for higher conversion rates and less cart abandonment. This goes for the checkout process, too.

For the final online step in the customer journey, offering ‘just the right amount’ of payment methods is crucial. Ensuring that the traditional (i.e. credit and debit card) options are there as well as the newer entrants (i.e. BNPL, digital wallets like Apple Pay) gives customers the option to choose that which they’re most comfortable with, where they are.

However, it’s important to understand your target audience and their behaviours and preferences so only the most valuable options are available.

Not only will this help with the first sale, but a smooth and simple checkout experience can help increase revenue and customer loyalty in the long term. Consider reviewing your checkout today to see if you are as relevant and accessible to your customers as possible.

At Planet, our online payment experts can help you to select the right mix of payment methods for your audience. We work with you to fine tune the checkout experience to get the best conversion possible.